In the fast-paced realm of financial trading, honing advanced price action strategies isn’t just a skill—it’s a crucial advantage. As we step into 2024, understanding these sophisticated strategies can significantly enhance your trading prowess. This comprehensive guide explores the advanced price action techniques that are shaping the landscape of trading strategies this year.

Introduction to Advanced Price Action Techniques

Price action trading involves examining past price movements to predict future trends. Unlike traditional indicators that use mathematical formulas, price action techniques focus on pure price movements, chart patterns, and candlestick formations. Mastering advanced price action techniques involves interpreting these movements with a deep understanding of market psychology and sentiment.

Dynamic Support and Resistance Levels

Key elements in price action trading include the dynamic nature of support and resistance levels, which significantly influence market movements.

Unlike static levels, which are fixed at specific price points, dynamic levels adjust continuously based on recent price movements. Traders frequently rely on instruments such as moving averages, trendlines, and Fibonacci retracements to pinpoint these fluctuating areas. Understanding dynamic support and resistance helps traders gauge the strength of buying and selling pressures in the market, enabling more precise entry and exit points.

Advanced Candlestick Patterns

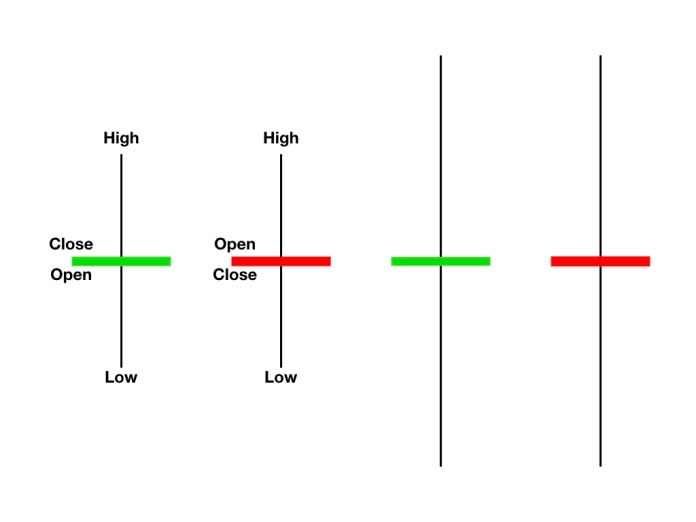

Candlestick patterns are fundamental to price action analysis, offering insights into market sentiment and potential reversals. While basic patterns like doji and hammer are widely recognized, advanced traders focus on more complex formations such as engulfing patterns, evening stars, and three inside-up patterns. Each pattern conveys specific implications for market direction and momentum, empowering traders to make informed decisions based on price action signals.

Volume Analysis Techniques

Integrating volume analysis with price action provides valuable confirmation for trading signals. Volume indicators such as volume bars, on-balance volume (OBV), and volume-weighted average price (VWAP) help assess the strength behind price movements. High volume during a breakout, for instance, suggests strong market conviction, reinforcing the likelihood of a sustained trend. Advanced traders combine price action patterns with volume analysis to validate their trading strategies effectively.

Confluence of Signals

Successful traders often look for confluence, where multiple indicators or signals align to strengthen the conviction in a trade. This approach involves combining technical tools such as moving averages, Fibonacci levels, and candlestick patterns to identify high-probability trade setups. By waiting for confluence before entering a trade, traders reduce the risk of false signals and increase the potential for profitable outcomes.

Advanced Trend Analysis Strategies

Identifying and trading with the trend is a cornerstone of price action trading. Advanced traders utilize sophisticated trend analysis techniques such as trend channels, moving average convergence divergence (MACD), and Ichi Moku Cloud to assess trend strength and direction. These tools help traders distinguish between trending and ranging markets, enabling them to adapt their strategies accordingly. Whether employing trend-following or counter-trend strategies, understanding trend dynamics is essential for maximizing trading opportunities.

Risk Management Practices

Beyond technical analysis, effective risk management is crucial for sustainable trading success. Advanced traders implement various risk management techniques, including setting stop-loss orders based on volatility levels, calculating position sizes relative to account equity, and diversifying across different asset classes. By managing risk prudently, traders protect capital during market downturns and preserve profitability over the long term.

Algorithmic Trading and Automation

In the era of technological advancement, algorithmic trading has revolutionized financial markets. Advanced traders harness algorithmic strategies to automate trade execution based on predefined criteria and mathematical models. These algorithms analyze large datasets, identify patterns, and execute trades at high speeds beyond human capacity. Additionally, automation allows traders to back test strategies, optimize parameters, and adapt to evolving market conditions swiftly. Incorporating algorithmic trading boosts trading efficiency and consistency, offering a distinct advantage in today’s rapidly moving markets.

Psychological Discipline in Trading

While technical skills are essential, mastering the psychological aspects of trading is equally critical. Advanced traders cultivate discipline to adhere to trading plans rigorously, manage emotions such as fear and greed, and maintain a resilient mindset during periods of market volatility. Maintaining discipline and remaining emotionally detached from trades enables traders to base their decisions on thorough analysis instead of impulsive reactions, which fosters long-term success in trading.

Conclusion

As we navigate the complexities of financial markets in 2024, mastering advanced price action techniques is paramount for traders seeking to stay ahead of the curve. From dynamic support and resistance levels to advanced candlestick patterns, volume analysis, trend analysis strategies, and risk management practices, each technique contributes to a comprehensive trading framework. By combining technical expertise with effective risk management and psychological discipline, traders can navigate market uncertainties with confidence and achieve sustainable trading success in the evolving landscape of 2024 and beyond.

Pingback: Intraday Trading for Beginners: Building a Solid Foundation

Pingback: Top 5 Trading Techniques to Boost Your Market Performance